Just as homeowners know the value of their homes and car owners know the value of their cars, so too is it essential that small and mid-sized manufacturers (SMMs) know the value of their businesses. Unlike the Kelley Blue Book, which has set the auto industry standard for valuing cars, the SMM community has historically lacked a global resource that helps business owners value their companies and determine what a willing third party will pay for their business.

The Delaware Valley Industrial Resource Center (DVIRC), which focuses exclusively on helping manufacturers in the region compete and grow profitably, has developed a solution to address the problem. Together with David Bernstein of RLS Associates, the company launched a tool called the Value Components Assessment, or VCAT, which identifies 28 drivers of business value and creates a scoring mechanism for each driver to determine the overall value of a business. DVIRC then conducted interviews with more than 40 companies, providing a score on each component and an overall score, along with a one-page recommendation of major opportunities to improve the overall score.

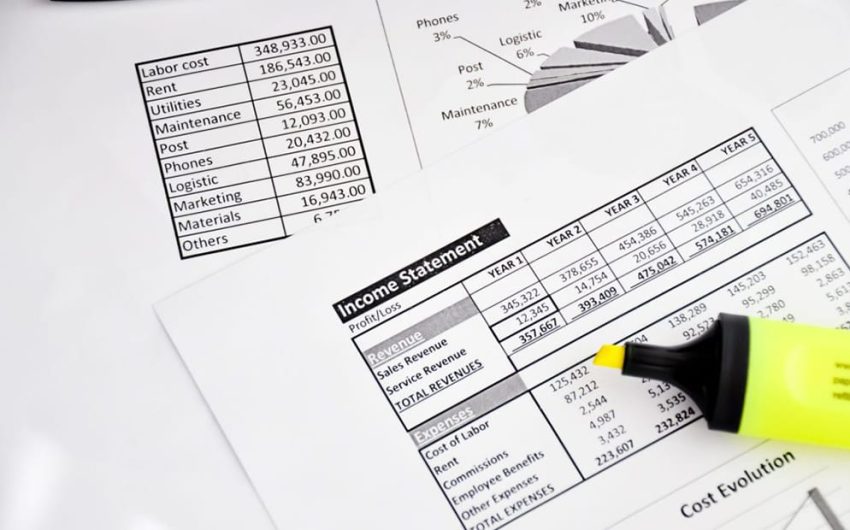

Recently, DVIRC examined the scores on each of the value components to obtain a view of a typical SMM. As the value components are not equally weighted, DVIRC decided to focus on the ones that are the biggest drivers of value. In the assessment, those components have weightings of 4 or 5 on a scale of 1-5. Truly understanding each of these 12 components* will help business owners define the actions needed and areas of focus to strengthen the business.

Our examination of the scores found that the median score of the companies interviewed (meaning the midpoint of scores, and half the companies were below and half were above) was only at a level of 2 for the following criteria:

- Revenue Trend: More than half the firms had average annual growth rates under 10% year, with most of those well below that.

- EBITDA: More than half the firms had EBITDA below $1MM annually.

- EBITDA as % of Sales: About half the manufacturing firms had profit margins in the mid-single digits or lower. This level of profitability typically leads to strains on working capital, especially cash.

- Top two Customer Concentration: About half of those surveyed had 20% or more of their sales coming from its top two customers. Loss of even one, particularly if product margins are low, can lead to a company life-or-death situation.

- Proprietary Products: The survey indicates that the typical firm only has 10% or less contribution to sales by new products.

In short, many manufacturing firms are operating in a slow-growth, low-profit situation with substantial customer concentration. Additionally, while not as low as the above, median scores for Management Strength and Depth and for Concentration of Knowledge Base and Responsibility were only 3 on a scale of 1-5.

So what does this all mean to you? Depending on your specific situation, there are many strategies you can employ. In general, company leaders with the above profile should endeavor to work more “on the business,” as opposed to “in the business,” by making specific plans and executing them to remedy their weak spots. DVIRC can help with this in two ways. First, we can conduct a VCAT to help you (and us) better understand your situation and what to do about it. Second, you can talk to a DVIRC Business Development Director to learn what assistance we can provide to address any weaknesses and improve business value. In any case, take action to preserve and then grow the value of your company!

To learn more about working with DVIRC to conduct a VCAT, contact us.

*Key VCAT Assessment Components

- Revenue Trend: Average annual sales growth over the last three years.

- EBITDA: Average dollar earnings before interest, taxes, depreciation, and amortization (EBITDA) over the last three years. Larger numbers are more attractive to buyers.

- EBITDA as % of sales: Average EBITDA as defined above as a percentage of sales. Higher percentages indicate a company with competitive advantage.

- EBITDA Trend: The trend in EBITDA over the last three years.

- Customer Concentration: The percent of sales accounted for by the top 2 customers.

- Customer Concentration: The ratio of customers that account for 80% of sales. This is a second measure of customer concentration. Customer concentration is a major issue for sustainable, transferable profitability, which determines customer value.

- Proprietary Products: The contribution to sales of proprietary products or processes. This is a strong indicator of the ability to innovate and is typically strongly correlated to higher EBITDA as a percent of sales.

- Management Strength and Depth: The extent to which management roles and responsibilities are well defined; the level of tenure and experience; whether succession and development plans are in place.

- Concentration of Knowledge Base and Responsibility: The extent to which these are spread out among many competent individuals, with cross-training and development plans in place.

- Revenue Generation by Owner or 1 Person: The percentage of sales delivered by the owner or the chief salesperson. A company is more vulnerable if key sales relationships are concentrated in one person. Competitors for Principal Products or Services: The extent to which there are competitors with similar products or services providing comparable or lower p